With U.S. consumers crossing off purchases on Christmas wish lists for loved ones, a larger portion than ever indicated they have debt "they will never be rid of," according to a creditcards.com survey.

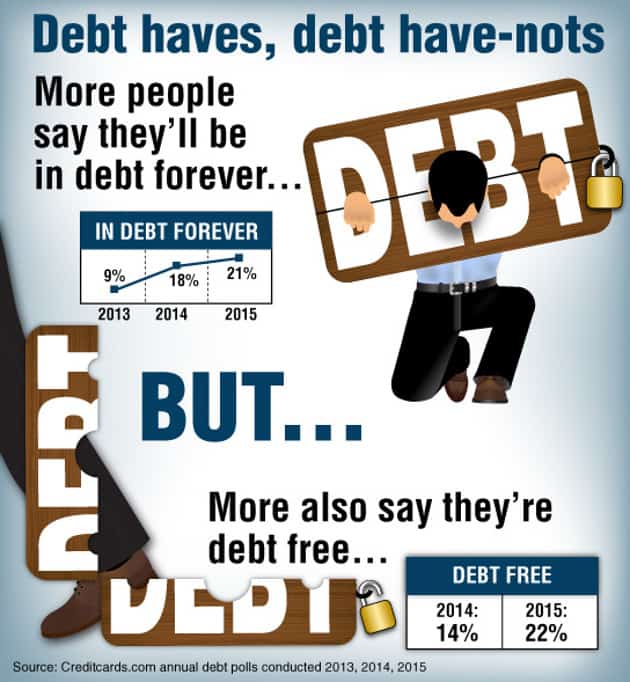

According to the survey, 21 percent of those with debt said they doubt they will ever be debt free, compared with 18 percent in 2014 and 9 percent in 2013. Oddly enough, a larger percentage than last year said they have no debt, 22 percent, up eight points.

Matt Schulz, a senior analyst for creditcards.com, noted the contrast, Lauren Gensler wrote for Forbes.

"It's a troubling divide," Gensler quoted Schulz as saying. "You have a bunch of people who are getting themselves out of debt for good, yet another group of people who feel trapped and hopeless and don't think they're ever going to get out of debt."

Creditcards.com's report noted that though the Christmas shopping season is relatively short, it adds debt and strains finances in a big way: The National Retail Federation found shoppers planned to spend $805 on holiday items in 2015.

Also, consumers make more unwise decisions this time of year - and the deploying of "psychological techniques" by businesses doesn't help, said Kathleen Riggs, a Utah State University extension professor of family and consumer sciences, to creditcards.com.

"It becomes difficult when people go to the mall, and they know they just want to pick up a sweater at the store," the report quoted Riggs as saying. "But they are surrounded with decorations, sale signs in the windows and the music, and they get caught up in that."

Still, solutions exist, even amid the shopping frenzy.

Riggs said shoppers should "not become too swept up" in the commercial part of the holiday season and should craft a list and stick to it, according to creditcards.com.

Forbes gave long-term advice that those trying to pay off more than one loan should note.

"When you have more than one type of debt, financial experts often suggest attacking the loans with higher interest rates first, which minimizes what you pay in the end," Gensler wrote for Forbes. "Another strategy is to focus on the smallest loans first, which is supposed to be the more rewarding way to go."

And Yahoo Finance indicated there's a plot twist in the pursuit of conquering all debt: Learning to "control and leverage debt" can help debtors reap some "serious rewards."

Negotiating with creditors, leveraging the payment cycle (charging something right before interest-free periods) and understanding repayment options all help shoppers, Jocelyn Black Hodes wrote for Yahoo Finance.